reverse tax calculator ontario

Employment income This is any monetary amount you receive as salary wages commissions bonuses tips. Any input field can be used.

Bad Credit Mortgage Financing In Ontario Bad Credit Mortgage Mortgage Help Mortgage

It is free for simple tax returns or gives you 10 discount for.

. This tax calculator is used for income tax estimationPlease use Intuit TurboTax if you want to fill your tax return and get tax rebate for previous year. It uniquely allows you to specify any combination of inputs when trying to figure out what your gross income needs to be for the desired net income. Formula for reverse calculating HST in Ontario.

Calculate GST with this simple and quick Canadian GST calculator. It ranges from 13 in ontario to 15 in other provinces and is composed of a provincial tax and a federal tax. Your average tax rate is 270 and your marginal tax rate is 353.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043That means that your net pay will be 37957 per year or 3163 per month. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. This will give you the items pre-tax cost.

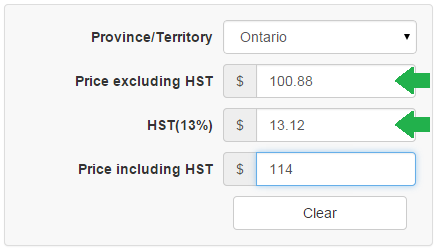

13 for Ontario 15 for others. Divide the price of the item post-tax by the decimal value. The given number will be the pre-HST number that will be calculated.

Enter your annual income taxes paid rrsp contribution into our calculator to estimate your return. It can be used as well to reverse calculate Goods and Services tax calculator. How to Calculate Reverse Sales Tax.

Enter price without HST HST value and price including HST will be calculated. Canada GST Calculator - You can now easily calculate GST for Canada. The reverse sales tax calculator exactly as you see it above is 100 free for you to use.

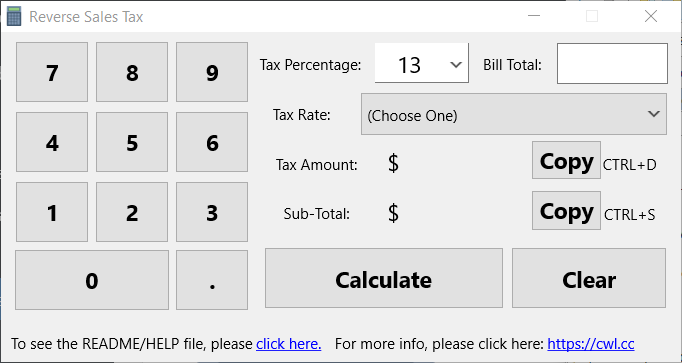

Who the supply is made to to learn. As well as entrepreneurs and anyone else who may need to figure out just how. Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes.

Reverse tax calculator ontario. This valuable tool has been updated for with latest figures and rules for working out taxes. Reverse Tax Calculator 2021-2022.

Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST. Your average tax rate is 270 and your marginal tax rate is 353This marginal tax rate means that your immediate additional income will be taxed at this rate. Current tax rates in Ontario and federal tax rates are listed below and check.

That means that your net pay will be 37957 per year or 3163 per month. The following table provides the GST and HST provincial rates since July 1 2010. It is very easy to use it.

Revenues from sales taxes such as the HST and RST are expected to total 281 billion or 265 of all of Ontarios taxation revenue during the 2019 fiscal year. Type of supply learn about what supplies are taxable or not. Enter HST inclusive price and calculate reverse HST value and Harmonized sales tax exclusive price.

HST Tax Rate. Calcul inversé de la taxe TVH soit la taxe de vente harmonisée 2022 pour lensemble du canada Ontario Colombie Britannique Nouvelle-Écosse Terre-Neuve-et-Labrador Manitoba Alberta et plus de provinces du Canada. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase.

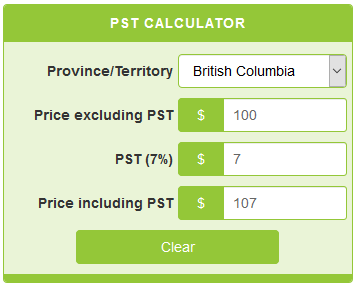

Calculates the canada reverse sales taxes HST GST and PST. Amount with sales tax 1 HST rate100 Amount without sales tax. The rate you will charge depends on different factors see.

Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax. This app is especially useful to all manner of professionals who remit taxes to government agencies. The Harmonized Sales Tax or HST is a sales tax that is.

Formula for reverse calculating hst in ontario. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. What is GST rate in Canada.

Calculate the total income taxes of the Ontario residents for 2021. Amount without sales tax GST rate GST amount. Amount without sales tax QST rate QST amount.

You have a total price with HST included and want to find out a price without Harmonized Sales Tax. Amount without sales tax x HST rate100 Amount of HST in Ontario. Following is the reverse sales tax formula on how to calculate reverse tax.

13 rows Overview of sales tax in Canada. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Just set it to the HST province that you want to reverse and enter in the after-tax dollar amount that you want to reverse.

Where the supply is made learn about the place of supply rules. This is greater than revenue from Ontarios Corporation Tax Health Premium and Education Property Tax combined. This is very simple HST calculator for Ontario province.

Enter HST value and get HST inclusive and HST exclusive prices. Here is how the total is calculated before sales tax. Lets calculate this value.

Income Tax Calculator Ontario 2021. The period reference is from january 1st 2021 to december 31 2021. Now you divide the items post-tax price by the decimal value youve just acquired.

All Harmonized Sales Tax calculators on this site can be used as well as reverse HST calculator. Subtract the price of. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Sales taxes make up a significant portion of Ontarios budget. Enter that total price into Price including HST input box at the bottom of calculator and you will get excluding HST value and HST value. GSTHST provincial rates table.

This calculator will help you get the net tax income after tax the percentage of tax of each government provincial and federal and all the contributions CPP and EI. Literally any combination of options works try it - from swapping to. This is income tax calculator for Ontario province residents for year 2012-2021.

HST reverse sales tax calculation or the Harmonized reverse Sales Tax calculator of 2022 for the entire Canada Ontario British Columbia Nova Scotia Newfoundland and Labrador and many more Canadian provinces. If you want a reverse HST calculator the above tool will do the trick. It is easy to calculate GST inclusive and exclusive prices.

2675 107 25.

Reverse Hst Gst Calculator All Provinces Rates Wowa Ca

Reverse Hst Gst Calculator All Provinces Rates Wowa Ca

Pst Calculator Calculatorscanada Ca

Want To Buy But No Down No Credit Bad Credit No Problem Classified Ad Bad Credit Bad Credit Score Loans For Bad Credit

The Customer Can Be Compare The Our Mortgage Plans To Take Care About His Money And Investment You Can Mortgage R Mortgage Lowest Mortgage Rates Mortgage Plan

20 For 20 Fine Silver Coin A Gingerbread Man Silver Coins Gold And Silver Coins Fine Silver

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Reverse Hst Gst Calculator All Provinces Rates Wowa Ca

Cynthia M Shelton S Esl Blog Visit Often Website Design Mortgage Second Mortgage

Reverse Hst Calculator Hstcalculator Ca

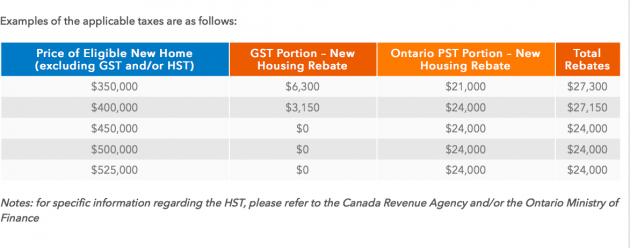

New Home Hst Rebate Calculator Ontario

Canada Sales Tax Gst Hst Calculator Wowa Ca

Mortgage Broker In Ontario Butler Mortgage

Impuestos Y Tasas Que Debes Pagar Al Construir Una Casa O Comprarla Inmobiliaria Impuestos Fiscalidad Comprarcasa C Home Buying Home Loans Home Mortgage